Great article explaining why interest rates are on the rise no matter what! Contact Zach and the Lucy Lending Team to see what your purchasing power is, get pre-qualified, pre-approved and lock in your rates! Zach and the Lucy Lending Team [email protected] 843-469-9010 http://time.com/money/4699429/mortgage-rates-federal-reserve/

Tag: Charleston

40TH ANNUAL COOPER RIVER BRIDGE RUN APRIL 1ST 2017!

40 years ago, if you were a runner in the Bridge Run, SC 40 years ago… you would be feeling the wobbling John P. Grace Memorial Bridge buckling underneath you as you crossed over the Cooper River from Mount Pleasant headed to downtown Charleston and finishing at our beloved Marion Square. The bridge was declared… Continue reading 40TH ANNUAL COOPER RIVER BRIDGE RUN APRIL 1ST 2017!

The Fed is 98% Likely to Raise Rates Next Week!

Federal Reserve Chief, Janet Yellen, again confirmed last week her intent to raise short-term interest rates this month,as long as inflation and employment data continue to meet the Fed’s expectations; which both are expected to do. The next Fed meeting is March 14-15, the Fed will most likely raise rates from the current 0.75% to… Continue reading The Fed is 98% Likely to Raise Rates Next Week!

Night at the Races Derby Gala May 6th!

And we are off to the races! Mark your calendars for the 2017 Night at the Races event held on Saturday May 6! 100% of the proceeds raised from this event will be donated to the Junior League of Charleston, Inc., in support of the League’s mission to develop the potential of women and help… Continue reading Night at the Races Derby Gala May 6th!

MARCH EVENTS IN CHARLESTON

Spring is definitely here! The first hint of blooms and our gorgeous native Southern Azalea’s are here…. along with a lovely dusting of pollen on anything and everything we have outside. March is home to some of our favorite events in the Lowcountry: Wine and Food Festival, Fashion Week, and the start of Flowertown Festival… Continue reading MARCH EVENTS IN CHARLESTON

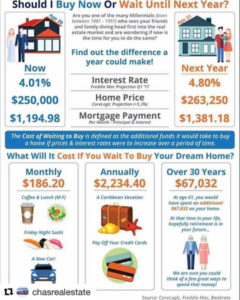

WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Are you thinking of buying a home? Are you not sure if you should go for it now or wait? With interest rates and home prices on the rise, this chart will show you how much you could be essentially “saving” and what you could potentially miss out on waiting to buy your dream home!… Continue reading WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Another Day In Paradise!!!

We are so lucky to call Charleston our home! Do you want to as well? Give Zach Larichiuta and the Lucy Lending Team a call to see how we can make your dreams come true! Follow us on Instagram @lucylendingteam https://www.instagram.com/lucylendingteam/ #sullivans #sullivansisland #charleston #chs #realestate #sunrise #nofilter #trusted #lender #financing #mortgage #homeowner #homebuyer #lucylendingteam… Continue reading Another Day In Paradise!!!

Lock-in Your Refinance Before September 14th!

The Federal Housing Finance Agency (FHFA) recently announced a new Adverse Market Fee that may impact your ability to take advantage of today’s historically low rates to refinance your current mortgage. Here’s everything you need to know about this new fee: WHO IS IMPOSING A FEE? AND HOW MUCH IS IT? Fannie Mae and Freddie… Continue reading Lock-in Your Refinance Before September 14th!

Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

Even after the new regulations imposed by the Truth-In-Lending/RESPA Integrated Disclosure (TRID) rules and disclosure forms implemented in October of 2015, a shockingly large amount of homebuyers still say their final closing costs caught them by surprise. Some are even unaware that closing costs were even required costs associated with their loan. ClosingCorp, a provider… Continue reading Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

SELF-EMPLOYED? Getting A Mortgage Is Not As Hard As You Think!

Call the Lucy lending Team today, to walk you through the process of obtaining financing as a business owner. We take the time to explain everything thoroughly, address additional concerns such as tax implications and get you in the best spot possible to purchase the home of your dreams. Zach and the Lucy Lending Team… Continue reading SELF-EMPLOYED? Getting A Mortgage Is Not As Hard As You Think!