Were you afraid of growing up and giving up your stress free childhood? Apparently Generation Z. has no fear at all. The post-Millennial crop of kids, those born in 1995 and later, are already moving into homeownership! Maria Lamagna, writing for MarketWatch says just shy of 100K members of Gen Z, whose ages top out… Continue reading MOVE OVER MILLENIALS, GENERATION Z IS ALREADY BUYING HOMES!

Tag: Charleston Mortgage Broker

HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

Zach Larichiuta and the Lucy Lending Team are thrilled to announce the 1% Down Payment Program available to our valued clients! With the newly released Homeownership Advantage Program; buyers no longer need a large sum of cash to secure a home. This program focuses on supporting first-time homebuyers, low- and moderate-income borrowers, and families in… Continue reading HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

The Fed is 98% Likely to Raise Rates Next Week!

Federal Reserve Chief, Janet Yellen, again confirmed last week her intent to raise short-term interest rates this month,as long as inflation and employment data continue to meet the Fed’s expectations; which both are expected to do. The next Fed meeting is March 14-15, the Fed will most likely raise rates from the current 0.75% to… Continue reading The Fed is 98% Likely to Raise Rates Next Week!

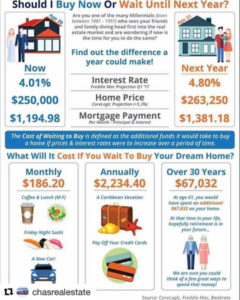

WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Are you thinking of buying a home? Are you not sure if you should go for it now or wait? With interest rates and home prices on the rise, this chart will show you how much you could be essentially “saving” and what you could potentially miss out on waiting to buy your dream home!… Continue reading WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

Even after the new regulations imposed by the Truth-In-Lending/RESPA Integrated Disclosure (TRID) rules and disclosure forms implemented in October of 2015, a shockingly large amount of homebuyers still say their final closing costs caught them by surprise. Some are even unaware that closing costs were even required costs associated with their loan. ClosingCorp, a provider… Continue reading Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

SELF-EMPLOYED? Getting A Mortgage Is Not As Hard As You Think!

Call the Lucy lending Team today, to walk you through the process of obtaining financing as a business owner. We take the time to explain everything thoroughly, address additional concerns such as tax implications and get you in the best spot possible to purchase the home of your dreams. Zach and the Lucy Lending Team… Continue reading SELF-EMPLOYED? Getting A Mortgage Is Not As Hard As You Think!

HOW DO HOA DUES EFFECT YOUR PURCHASING POWER WHEN BUYING A CONDO?

Great article about how HOA dues are a commonly overlooked fee and how it effects your purchasing power when buying a condo. Do you want to see the how much you can afford? Contact the Lucy Lending Team today and find out. http://www.delmarvahomerelief.com/blog/how-much-mortgage-can-i-afford-with-a-condo-association?utm_campaign=Mortgages&utm_content=45455604&utm_medium=social&utm_source=facebook www.charlestonmortgagelender.com 843-469-9010 [email protected] #charleston #chs #hoa #fees #realestate #purchasing #power #condo #condominium… Continue reading HOW DO HOA DUES EFFECT YOUR PURCHASING POWER WHEN BUYING A CONDO?

FHA Suspends Reduction of Annual Mortgage Insurance Premium

And just like that it is gone….. The FHA has suspended the annual reduction of Annual Mortgage Insurance Premiums. For the full story you can click here. This is how quick things can change in the mortgage world and why it is so important to use a dependable lender who stays abreast these important updates.… Continue reading FHA Suspends Reduction of Annual Mortgage Insurance Premium

Interest Rates are Pushing Millennials out of the Charleston Housing Market

Rising Interest Rates As we see interest rates increase daily, adding additional stress for millennials and all members of the X and Y generation to purchase a home. According to a recent analysis from Fitch Ratings this obstacle has affected the younger generation significantly. The impact has cut down the millennials mortgage capacity by 9%… Continue reading Interest Rates are Pushing Millennials out of the Charleston Housing Market

FHFA ANNOUNCES MAXIMUM CONFORMING LOAN LIMITS FOR 2019

FHFA ANNOUNCES MAXIMUM CONFORMING LOAN LIMITS FOR 2019 Fannie Mae and Freddie Mac Baseline Limit Will Increase to $484,350 FOR IMMEDIATE RELEASE 11/27/2018 Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2019. In most of… Continue reading FHFA ANNOUNCES MAXIMUM CONFORMING LOAN LIMITS FOR 2019