Cooler weather is coming and we are certainly ready for a break from the heat! September brings the Jazz Fest, Charleston Restaurant Week, and Charleston Beer Week all in the same month. Here is your September calendar of events: Aug 30-Sept24: Disney’s The Little Mermaid, Dock St Theater 1-3: 9th Lowcountry Jazz Festival, N Chas… Continue reading SEPTEMBER CALENDAR OF EVENTS IN CHARLESTON

Tag: Charleston Housing Market

5 HOUSING TRENDS WE EXPECT IN 2017

Many real estate experts are predicting an overall positive housing market for 2017, despite the uptick in interest rates that are checking in at 4.25 percent and higher as of June 1. Compared with below 4 percent in 2016, this rate rise could slow home sales. But, since interest rates are still at historic lows… Continue reading 5 HOUSING TRENDS WE EXPECT IN 2017

HEY DOC! HOW ABOUT 275K MORE BUYING POWER?!

DOCTOR LOAN PROGRAM: As of 2015, the average student loan debt of a doctor was estimated at $183,000. With the current prevailing student loan interest rate at 6.31% with an average length of repayment of 21 that is a estimated a total payment of $1,312. With today’s rate still at historic lows hovering around 4%,… Continue reading HEY DOC! HOW ABOUT 275K MORE BUYING POWER?!

HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

Zach Larichiuta and the Lucy Lending Team are thrilled to announce the 1% Down Payment Program available to our valued clients! With the newly released Homeownership Advantage Program; buyers no longer need a large sum of cash to secure a home. This program focuses on supporting first-time homebuyers, low- and moderate-income borrowers, and families in… Continue reading HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

Why Mortgage Rates Will Keep Rising Regardless of What the Fed Does This Week

Great article explaining why interest rates are on the rise no matter what! Contact Zach and the Lucy Lending Team to see what your purchasing power is, get pre-qualified, pre-approved and lock in your rates! Zach and the Lucy Lending Team [email protected] 843-469-9010 http://time.com/money/4699429/mortgage-rates-federal-reserve/

The Fed is 98% Likely to Raise Rates Next Week!

Federal Reserve Chief, Janet Yellen, again confirmed last week her intent to raise short-term interest rates this month,as long as inflation and employment data continue to meet the Fed’s expectations; which both are expected to do. The next Fed meeting is March 14-15, the Fed will most likely raise rates from the current 0.75% to… Continue reading The Fed is 98% Likely to Raise Rates Next Week!

MARCH EVENTS IN CHARLESTON

Spring is definitely here! The first hint of blooms and our gorgeous native Southern Azalea’s are here…. along with a lovely dusting of pollen on anything and everything we have outside. March is home to some of our favorite events in the Lowcountry: Wine and Food Festival, Fashion Week, and the start of Flowertown Festival… Continue reading MARCH EVENTS IN CHARLESTON

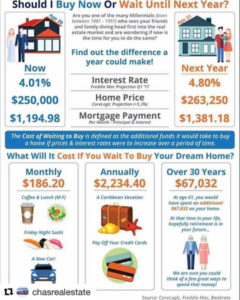

WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Are you thinking of buying a home? Are you not sure if you should go for it now or wait? With interest rates and home prices on the rise, this chart will show you how much you could be essentially “saving” and what you could potentially miss out on waiting to buy your dream home!… Continue reading WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

5 Things To Hide Before Selling Your Home!

This quick video is quite entertaining, but very true and prevalent for Charlestonians! Keep your home neutral and allow the buyers to focus on the house and not items in it. If you need help selling your property and do not have a realtor, call us for a trusted suggestion. Need to get qualified for… Continue reading 5 Things To Hide Before Selling Your Home!

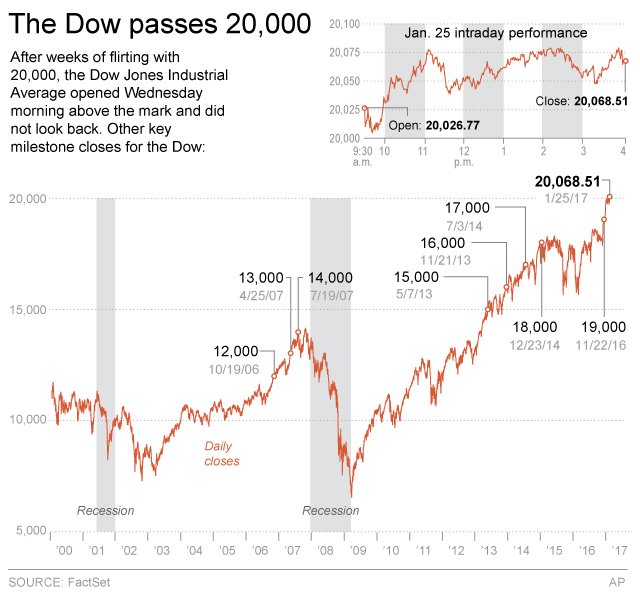

How the Dow Jones Industrial Average Effects Mortgages

A great explanation of how the Dow Jones Industrial Average effects the economy and mortgage market. As government bonds that drive mortgage rate increases as stock prices soar. This occurs because as investors put more money into the stock markets, the market tends to shift away from the bond markets. This creates an inverse reaction… Continue reading How the Dow Jones Industrial Average Effects Mortgages