Were you afraid of growing up and giving up your stress free childhood? Apparently Generation Z. has no fear at all. The post-Millennial crop of kids, those born in 1995 and later, are already moving into homeownership! Maria Lamagna, writing for MarketWatch says just shy of 100K members of Gen Z, whose ages top out… Continue reading MOVE OVER MILLENIALS, GENERATION Z IS ALREADY BUYING HOMES!

Tag: First Time Home Buyers

6 Reasons Charleston Is The Perfect Home For You!

Charleston, South Carolina: the largest and oldest city in the entire state. This gorgeous port city, which was founded in 1670, has been around to witness America’s best and worst moments. It’s now evolved into a festive, bustling town that anybody would be lucky to lay eyes on. Charleston represents a harmonious marriage of the… Continue reading 6 Reasons Charleston Is The Perfect Home For You!

June Events In Charleston!

June is here and it is already steamy! Spoleto is almost half way over, but there are still lots of amazing things to enjoy from it. Our very own Stingrays Hockey team has made it to the Championship Finals of the Kelly Cup. If you love our local hero Bill Murray as much as we… Continue reading June Events In Charleston!

Fannie Mae Helps Borrowers with Student Loan Debt Qualify for a Mortgage!

Fannie Mae announced April 25th that they will make it easier for borrowers with student loans to qualify for a mortgage. This is great new for current and former students who have been overburdened by student loan debt. These changes will go into effect May 1st 2017. The Economist reported in June 2014 that U.S.… Continue reading Fannie Mae Helps Borrowers with Student Loan Debt Qualify for a Mortgage!

HEY DOC! HOW ABOUT 275K MORE BUYING POWER?!

DOCTOR LOAN PROGRAM: As of 2015, the average student loan debt of a doctor was estimated at $183,000. With the current prevailing student loan interest rate at 6.31% with an average length of repayment of 21 that is a estimated a total payment of $1,312. With today’s rate still at historic lows hovering around 4%,… Continue reading HEY DOC! HOW ABOUT 275K MORE BUYING POWER?!

HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

Zach Larichiuta and the Lucy Lending Team are thrilled to announce the 1% Down Payment Program available to our valued clients! With the newly released Homeownership Advantage Program; buyers no longer need a large sum of cash to secure a home. This program focuses on supporting first-time homebuyers, low- and moderate-income borrowers, and families in… Continue reading HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

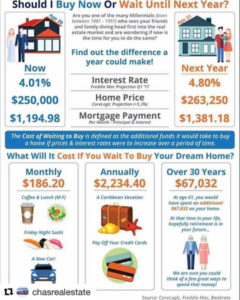

WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Are you thinking of buying a home? Are you not sure if you should go for it now or wait? With interest rates and home prices on the rise, this chart will show you how much you could be essentially “saving” and what you could potentially miss out on waiting to buy your dream home!… Continue reading WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

Even after the new regulations imposed by the Truth-In-Lending/RESPA Integrated Disclosure (TRID) rules and disclosure forms implemented in October of 2015, a shockingly large amount of homebuyers still say their final closing costs caught them by surprise. Some are even unaware that closing costs were even required costs associated with their loan. ClosingCorp, a provider… Continue reading Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

HOW DO HOA DUES EFFECT YOUR PURCHASING POWER WHEN BUYING A CONDO?

Great article about how HOA dues are a commonly overlooked fee and how it effects your purchasing power when buying a condo. Do you want to see the how much you can afford? Contact the Lucy Lending Team today and find out. http://www.delmarvahomerelief.com/blog/how-much-mortgage-can-i-afford-with-a-condo-association?utm_campaign=Mortgages&utm_content=45455604&utm_medium=social&utm_source=facebook www.charlestonmortgagelender.com 843-469-9010 [email protected] #charleston #chs #hoa #fees #realestate #purchasing #power #condo #condominium… Continue reading HOW DO HOA DUES EFFECT YOUR PURCHASING POWER WHEN BUYING A CONDO?

FHFA ANNOUNCES MAXIMUM CONFORMING LOAN LIMITS FOR 2019

FHFA ANNOUNCES MAXIMUM CONFORMING LOAN LIMITS FOR 2019 Fannie Mae and Freddie Mac Baseline Limit Will Increase to $484,350 FOR IMMEDIATE RELEASE 11/27/2018 Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2019. In most of… Continue reading FHFA ANNOUNCES MAXIMUM CONFORMING LOAN LIMITS FOR 2019