DOCTOR LOAN PROGRAM: As of 2015, the average student loan debt of a doctor was estimated at $183,000. With the current prevailing student loan interest rate at 6.31% with an average length of repayment of 21 that is a estimated a total payment of $1,312. With today’s rate still at historic lows hovering around 4%,… Continue reading HEY DOC! HOW ABOUT 275K MORE BUYING POWER?!

Tag: Charleston Mortgage Lender

The Fed is 98% Likely to Raise Rates Next Week!

Federal Reserve Chief, Janet Yellen, again confirmed last week her intent to raise short-term interest rates this month,as long as inflation and employment data continue to meet the Fed’s expectations; which both are expected to do. The next Fed meeting is March 14-15, the Fed will most likely raise rates from the current 0.75% to… Continue reading The Fed is 98% Likely to Raise Rates Next Week!

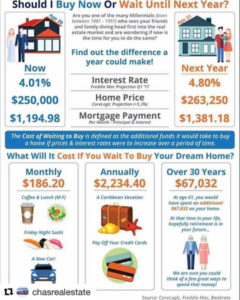

WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Are you thinking of buying a home? Are you not sure if you should go for it now or wait? With interest rates and home prices on the rise, this chart will show you how much you could be essentially “saving” and what you could potentially miss out on waiting to buy your dream home!… Continue reading WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

Even after the new regulations imposed by the Truth-In-Lending/RESPA Integrated Disclosure (TRID) rules and disclosure forms implemented in October of 2015, a shockingly large amount of homebuyers still say their final closing costs caught them by surprise. Some are even unaware that closing costs were even required costs associated with their loan. ClosingCorp, a provider… Continue reading Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

SELF-EMPLOYED? Getting A Mortgage Is Not As Hard As You Think!

Call the Lucy lending Team today, to walk you through the process of obtaining financing as a business owner. We take the time to explain everything thoroughly, address additional concerns such as tax implications and get you in the best spot possible to purchase the home of your dreams. Zach and the Lucy Lending Team… Continue reading SELF-EMPLOYED? Getting A Mortgage Is Not As Hard As You Think!

HOW DO HOA DUES EFFECT YOUR PURCHASING POWER WHEN BUYING A CONDO?

Great article about how HOA dues are a commonly overlooked fee and how it effects your purchasing power when buying a condo. Do you want to see the how much you can afford? Contact the Lucy Lending Team today and find out. http://www.delmarvahomerelief.com/blog/how-much-mortgage-can-i-afford-with-a-condo-association?utm_campaign=Mortgages&utm_content=45455604&utm_medium=social&utm_source=facebook www.charlestonmortgagelender.com 843-469-9010 [email protected] #charleston #chs #hoa #fees #realestate #purchasing #power #condo #condominium… Continue reading HOW DO HOA DUES EFFECT YOUR PURCHASING POWER WHEN BUYING A CONDO?

February In Charleston

February in Charleston is here. We all know that means Super Bowl time! For all the animal lovers out there is the annual Dock Dog competition and all things SEWE on the weekend of 17-19. Amazingly, Dave Chappelle is in town for 4 shows in 2 nights at the Music Hall. (Bill Murray has been… Continue reading February In Charleston

FHA Suspends Reduction of Annual Mortgage Insurance Premium

And just like that it is gone….. The FHA has suspended the annual reduction of Annual Mortgage Insurance Premiums. For the full story you can click here. This is how quick things can change in the mortgage world and why it is so important to use a dependable lender who stays abreast these important updates.… Continue reading FHA Suspends Reduction of Annual Mortgage Insurance Premium

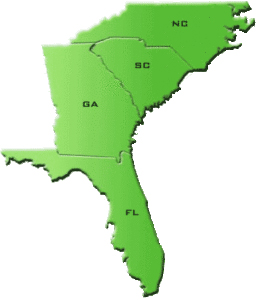

WE ARE LICENSED IN MULTIPLE STATES

Did you know that Zach Larichiuta and the Lucy Lending Team of Charleston are licensed in multiple states? We are now licensed in North Carolina, George and Florida: as well as our established license and presence in South Carolina. We feel it is vital to be available to our valued clients in every capacity that… Continue reading WE ARE LICENSED IN MULTIPLE STATES

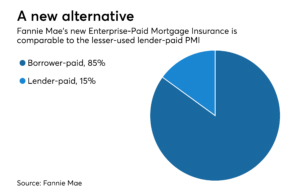

EPMI – Enterprise Paid Mortgage Insurance

Most people are familiar with the term “Borrower Paid Mortgage Insurance”, as well as the option for “Lender Paid Mortgage Insurance”. This past July, Fannie Mae, announced the introduction of an additional mortgage insurance pilot program. The mortgage insurance option is called Enterprise-Paid Mortgage Insurance (EPMI) and allows a lender to deliver an over 80%… Continue reading EPMI – Enterprise Paid Mortgage Insurance