Around the time when millennials were criticized for their love of pink and avocados, a myth began to emerge that the 18-36 age group are uninterested in buying homes. While there are many reasons why this misperception exists, the truth is, millennials are just as interested in making this life-changing investment as previous generations were.… Continue reading MYTH: MILLENIALS AREN’T BUYING HOMES

Tag: Charleston Mortgage

Charleston Area Events March 30 – April 1st, 2018

Easter is Here! And so is Spring and all the fun events that come with it! Get your family geared up for a fun Holiday weekend in the Lowcountry! Charleston is a city that always knows how to celebrate the joys of life every day, but when a holiday is on the horizon, the city… Continue reading Charleston Area Events March 30 – April 1st, 2018

MOVE OVER MILLENIALS, GENERATION Z IS ALREADY BUYING HOMES!

Were you afraid of growing up and giving up your stress free childhood? Apparently Generation Z. has no fear at all. The post-Millennial crop of kids, those born in 1995 and later, are already moving into homeownership! Maria Lamagna, writing for MarketWatch says just shy of 100K members of Gen Z, whose ages top out… Continue reading MOVE OVER MILLENIALS, GENERATION Z IS ALREADY BUYING HOMES!

CHARLESTON NOVEMBER CALENDAR OF EVENTS

It’s time to break out those boots, scarves, and hats. November is here and that means cooler weather, the Carolina Fair, and oyster roasts are coming to Charleston. Thanksgiving is also upon us and the holiday season opens with the Holiday Festival of Lights at the James Island County Park. Here are your November calendar… Continue reading CHARLESTON NOVEMBER CALENDAR OF EVENTS

6 Reasons Charleston Is The Perfect Home For You!

Charleston, South Carolina: the largest and oldest city in the entire state. This gorgeous port city, which was founded in 1670, has been around to witness America’s best and worst moments. It’s now evolved into a festive, bustling town that anybody would be lucky to lay eyes on. Charleston represents a harmonious marriage of the… Continue reading 6 Reasons Charleston Is The Perfect Home For You!

HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

Zach Larichiuta and the Lucy Lending Team are thrilled to announce the 1% Down Payment Program available to our valued clients! With the newly released Homeownership Advantage Program; buyers no longer need a large sum of cash to secure a home. This program focuses on supporting first-time homebuyers, low- and moderate-income borrowers, and families in… Continue reading HAVE YOU AVOIDED LOOKING TO BUY A HOME BECA– USE YOU FEAR YOU WILL NOT HAVE ENOUGH MONEY?

Why Mortgage Rates Will Keep Rising Regardless of What the Fed Does This Week

Great article explaining why interest rates are on the rise no matter what! Contact Zach and the Lucy Lending Team to see what your purchasing power is, get pre-qualified, pre-approved and lock in your rates! Zach and the Lucy Lending Team [email protected] 843-469-9010 http://time.com/money/4699429/mortgage-rates-federal-reserve/

The Fed is 98% Likely to Raise Rates Next Week!

Federal Reserve Chief, Janet Yellen, again confirmed last week her intent to raise short-term interest rates this month,as long as inflation and employment data continue to meet the Fed’s expectations; which both are expected to do. The next Fed meeting is March 14-15, the Fed will most likely raise rates from the current 0.75% to… Continue reading The Fed is 98% Likely to Raise Rates Next Week!

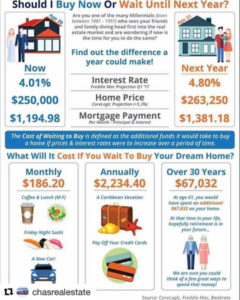

WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Are you thinking of buying a home? Are you not sure if you should go for it now or wait? With interest rates and home prices on the rise, this chart will show you how much you could be essentially “saving” and what you could potentially miss out on waiting to buy your dream home!… Continue reading WHAT WILL IT COST TO BUY YOUR DREAM HOME NEXT YEAR?

Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!

Even after the new regulations imposed by the Truth-In-Lending/RESPA Integrated Disclosure (TRID) rules and disclosure forms implemented in October of 2015, a shockingly large amount of homebuyers still say their final closing costs caught them by surprise. Some are even unaware that closing costs were even required costs associated with their loan. ClosingCorp, a provider… Continue reading Seventeen Percent of Consumers Are Unaware That Mortgages Involve Closing Costs!