March offers so many wonderful events for everyone in the Low Country! The Historic Charleston Foundation kicks offspring with the 2019 Festival of Houses and Gardens running from the 13th until April 18. We’ve got the Food + Wine Festival, St Patrick’s celebrations, great comedy, and the world’s top female tennis players come together for… Continue reading MARCH CALENDAR OF EVENTS IN CHARLESTON

Tag: Zach Larichiuta

Is Your Second Mortgage’s Interest Rate Too High?

Call us TODAY! We can get you out of that commitment by these tips here! Apply for your mortgage here. Zach and the Lucy Lending Team 843-469-9010 [email protected] www.charlestonmortgagelender.com #secondmortgage #mortgage #interestrates #broker #lender #savemoney #money #bills #refinance #zachlarichiuta #lucylendingteam

Mortgage Rates Hit a 12-Month Low As Economic Expansion Looks Vulnerable.

Lock now! Call us to get a rate quote! Read more HERE. Apply for your mortgage HERE! Zach Larichiuta and the Lucy Lending Team 843-469-901 [email protected] #RealEstate #CHSRealEstate #InterestRates #Charleston #Mortgage #Investor #Homeowner #LockNow #ZachLarichiuta #LucyLendingTeam #Broker

Mortgage Rates Fall to 3-Week Lows After Fed

Mortgage rates fell moderately today, largely in response to the Federal Reserve’s policy announcement. Federal Reserve Chairman Jerome Powell issued his strongest statement yet Wednesday that the central bank has changed its outlook regarding interest rate hikes. “The case for raising rates has weakened somewhat,” Powell said during a news conference following this week’s two-day… Continue reading Mortgage Rates Fall to 3-Week Lows After Fed

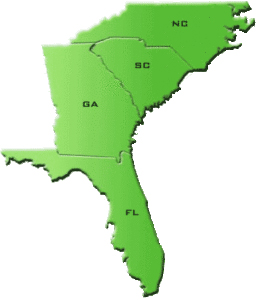

WE ARE LICENSED IN MULTIPLE STATES

Did you know that Zach Larichiuta and the Lucy Lending Team of Charleston are licensed in multiple states? We are now licensed in North Carolina, George and Florida: as well as our established license and presence in South Carolina. We feel it is vital to be available to our valued clients in every capacity that… Continue reading WE ARE LICENSED IN MULTIPLE STATES

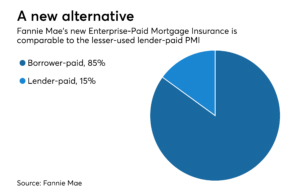

EPMI – Enterprise Paid Mortgage Insurance

Most people are familiar with the term “Borrower Paid Mortgage Insurance”, as well as the option for “Lender Paid Mortgage Insurance”. This past July, Fannie Mae, announced the introduction of an additional mortgage insurance pilot program. The mortgage insurance option is called Enterprise-Paid Mortgage Insurance (EPMI) and allows a lender to deliver an over 80%… Continue reading EPMI – Enterprise Paid Mortgage Insurance

WHAT A GOVERNMENT SHUTDOWN MEANS TO THE MORTGAGE INDUSTRY

1. Flood Insurance 1. No new policies and/or renewals will be processed. Therefore, if a loan requiring flood insurance does not have the proper insurance in place, it cannot close under any circumstance. 1. If the policy was paid before the shut down or is not yet due for renewal, there is no impact. The… Continue reading WHAT A GOVERNMENT SHUTDOWN MEANS TO THE MORTGAGE INDUSTRY