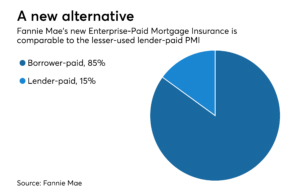

Most people are familiar with the term “Borrower Paid Mortgage Insurance”, as well as the option for “Lender Paid Mortgage Insurance”. This past July, Fannie Mae, announced the introduction of an additional mortgage insurance pilot program. The mortgage insurance option is called Enterprise-Paid Mortgage Insurance (EPMI) and allows a lender to deliver an over 80% loan-to-value (LTV) mortgage to Fannie Mae without acquiring mortgage insurance prior to loan delivery. Instead Fannie Mae charges an additional loan-level price adjustment. Then, they secure coverage under a forward insurance arrangement from a Fannie Mae approved qualified insurer, or an approved traditional mortgage insurer.

“This new lender option enables us to streamline the operational requirements of participating lender customers, increase the certainty of coverage for our credit investor partners, and better manage Fannie Mae’s counterparty risk,” wrote Rob Schaefer, Fannie Mae vice president of credit enhancement strategy and management.

The EPMI program is similar to Freddie Mac’s Integrated Mortgage Insurance (IMAGIN) program; which was introduced in March. With IMAGIN, Freddie insurers low LTV mortgages using a group of approved insurers and reinsurers managed by Arch Mortgage Risk Transfer, a subsidiary of Arch Capital.

The Fannie EPMI mortgage insurance policy term is 10 years. An exception to that term will be in cases when the loan is delinquent at the end of the term. In those scenarios, the policy will remain in effect until the policy fully cures.

Fannie say EPMI offers a streamlined process for mortgage lenders, processors and underwriters. Fannie will handle the details of acquiring the insurance, fully determining loan eligibility, and filing claims.

The decision to utilize the EPMI option will be made between the lender and the borrower. If it is determined that EPMI is not better option for the borrower, borrower-paid and lender paid options may continue to be utilized. Fannie Mae believes EPMI will be yet another way for lenders to better serve their customers.

Homebridge and the Lucy Lending Team are one of the exclusive lenders in the country to offer this new option to our valued clients. We always love the opportunity to have an extensive number of products and options available to our clients. That being said, we pride ourselves on taking the time to review each individual’s personal scenario and goals with their mortgage transaction and align them with the appropriate product that benefits them the most.

If you would like to learn more about EPMI or how Zach Larichiuta and the Lucy Lending Team can assist you with your mortgage lending needs, call us to set up a face to face consultation; which is always free and part of our team’s method to educate and put our clients in the best position for their mortgage investments.

Zach and the Lucy Lending Team 843-469-9010 zach@lucylendingteam.com

#EPMI #mortgageinsurance #BPMI #LPMI #Charleston #RealEstate #local #trusted #tenured #advisor #broker #lender #mortgagelender #financing #homeowner #homebuyer #zachlarichiuta #lucylendingteam